Old Navy is one of those tried-and-true brands, the kind of place you go with the whole family on a Saturday afternoon. At least, that’s been the American retailer’s image since its genesis in 1994. Its parent company, Gap Inc., has steered the ship for years, and for good reason: Old Navy was nearly spun-off as a separate business entity earlier this year, but due to its success as well as Gap’s struggles, the decision was nixed.

On average, Old Navy produces and sells 700 million products per year, and in 2019 it was ranked Canada’s sixth largest apparel retailer. But this year changed things; or rather, it made some issues more apparent in light of the pandemic. In the first quarter of 2020, Old Navy’s net sales were down 42%, and all of its China locations were terminated. Lack of desirable assortment and designs were largely to blame, as well as its increasingly unsustainable reputation as a fast fashion retailer. Trend forecasting is one way for Old Navy work toward a better strategy: by anticipating what its customers want up to one year in advance in the context of market trends, accurate collection planning is suddenly much more intuitive and reduces waste.

The long-term: Old Navy’s problems and solutions

Old Navy is one of the many American retailers looking to better understand what their customer wants in the context of an increasingly data-driven industry. Target, Hollister, American Eagle Outfitters, and TJ Maxx are just a few examples of those who present competition, and in a time where American retail is being weakened by Covid, proactivity has to be a state of being. Presently, Old Navy is focused on goals that have been brought to light by this year’s changes:

- Increasing profitability and sell-through

- Avoiding missed revenue

- Strengthening their position as one of the top retailers in America

- Embracing more sustainable practices

These issues can largely be addressed with a slight change in strategy: looking to your customers and the market at large. In the simplest terms, consumers want to keep their wardrobes up-to-date with what’s trending. Fortunately, Old Navy has the advantage of having a strong brand identity already, which makes targeting both their existing and potential audience much lighter work. They have strong brand awareness with over 1000 stores notably in North America, they are known for producing decent quality apparel at fairly low prices, and they are category leaders in family apparel in the US.

Additionally, Old Navy has managed to connect with younger demographics quite well, despite customers becoming less brand loyal as the industry changes. Old Navy’s desire to turn toward the mantra of sustainability has begun attracting these younger consumers as well, but there is still progress to be made. The plan, according to Gap Inc. executives, is to “turn Old Navy into a 10-billion-dollar company.” So how can they get there?

Better design and assortment planning with trend forecasting

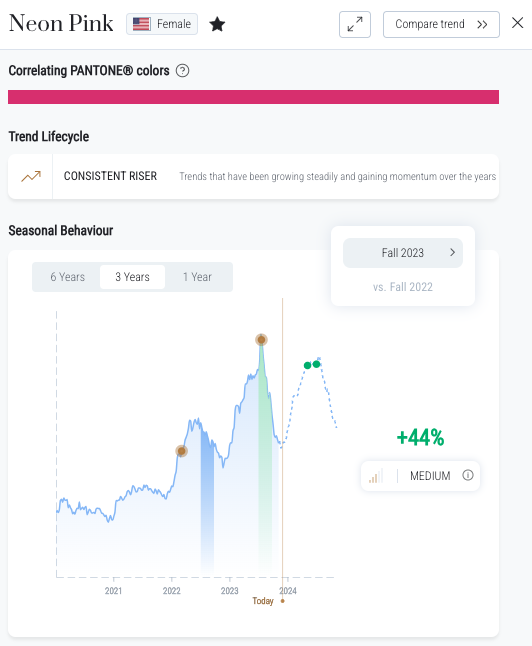

This is where trend forecasting comes in: It is the act of predicting how fashion trends will behave by analyzing their past and present behavior. There are myriad places to look for this sort of information, from runways to street style to store sales. Heuritech in particular, though, uses in-house artificial intelligence technology to analyze over 3 million shared images per day on social media. This approach provides real-time, real-life data: social channels such as Instagram and Weibo attract millions of users each day, and it is here that fashion trends are expressed and diffused at breakneck speed.

Heuritech can detect over 2000 attributes in images, including patterns, colors, shapes, textures, and more, which allows for precision when categorizing and evaluating each trend. For fashion brands and retailers, each team can use this data differently: design teams can better decide what to create, buyers and merchandisers can more accurately calculate collection assortment, and marketing teams can orient their communication to the proper audience at the proper time.

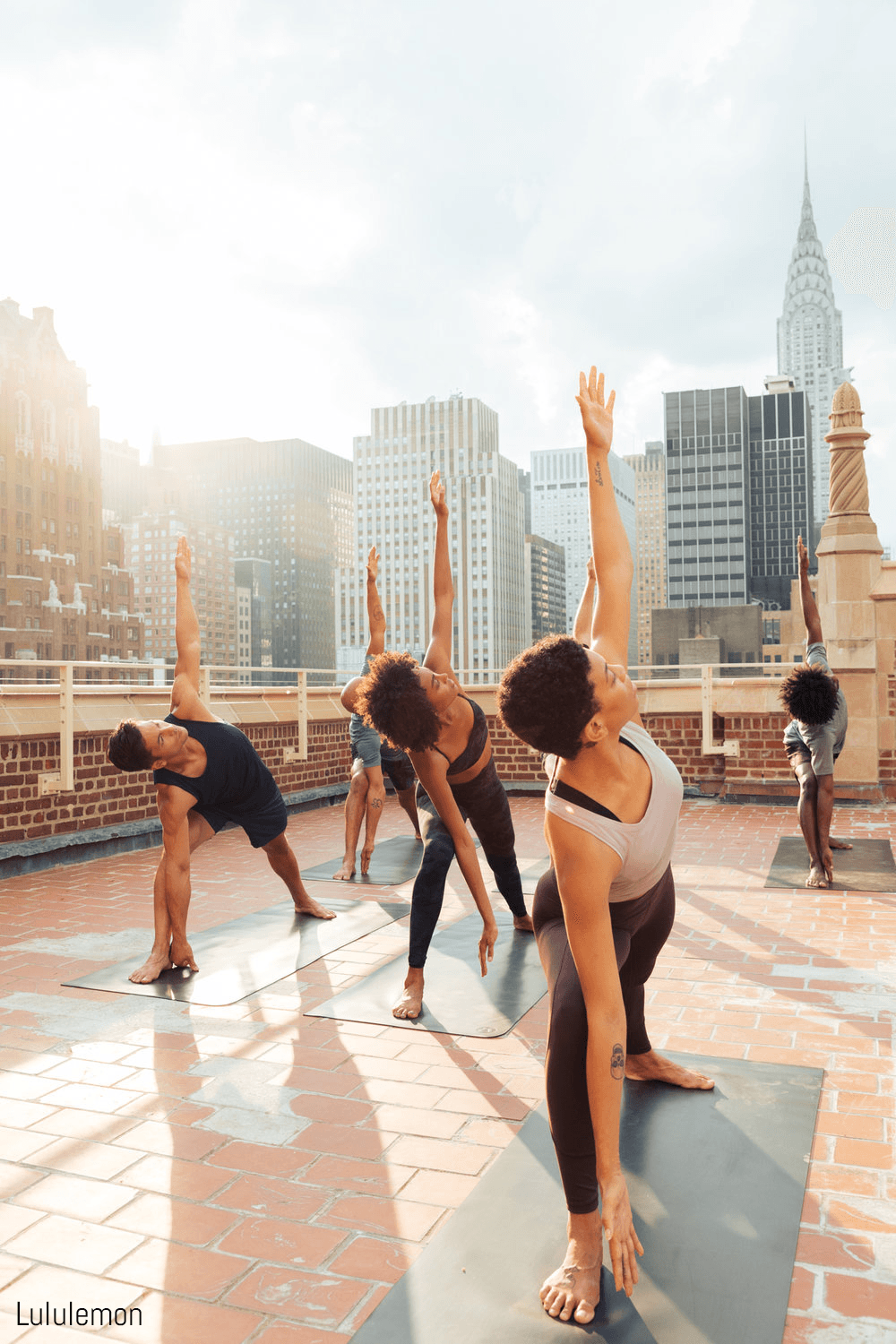

The first step to collection planning is design. But even before design, one must know what to design. Old Navy is known for its rockstar jeans, activewear, and graphic t-shirts, but different audiences want different products, and in different styles to the classic Old Navy look. Data-driven insights can make the difference — what parents shopping at Old Navy want may not align with what their kids want. Having an awareness of upcoming trends allows design teams to create best-sellers, and in the case of Old Navy, they’d like to strengthen the performance of their women’s category. To do this, the retailer can use Heuritech’s predictive technology to analyze this demographic’s favorite trends. Design is only the first step, though: knowing how much of a product to produce and sell is essential for responsible inventory planning.

So the key is knowing what, and how much, to include in your collections. Back in 2018, for instance, sales growth at Old Navy dipped, notably due to fashion misses in their women’s assortment. Several sources allude to pants specifically: According to Modern Retail, the main hiccup was with a lack of wide-legged denim and a surplus of skinny jeans. Their variety of colors wasn’t sufficient, either.

Gabriella Santaniello, analyst and founder of retail research firm A Line Partners, affirms to Business Insider:

“There were a lot of product misses. The assortments overall lacked fashion, the color palettes were off, they didn’t take any risks so anything that was remotely fashionable sold out immediately.”

Miscalculating collections is a misstep at best and a reason to sink at worst, so understanding assortment planning and consumer desires is decisive. Old Navy’s planning and merchandising teams must be able to produce the right quantities of the right products in order to increase the retailer’s sell-through and avoid inventory waste. Trend forecasting allows these teams to have the data to reach the proper conclusion; for example, upping the variety and amount of wide-legged pants in lieu of skinny jeans.

And of course, data-driven forecasts are backed by historical data just as by predictive data. This is important because it allows Old Navy to strike a balance between keeping customers loyal with old favorites, while appealing to more fashion-conscious shoppers that have a tendency to be “trendier”. Old Navy has a strong customer core of moms, so while this audience shouldn’t be ignored moving forward, millennials and Gen Zers need to be considered, too. So while the rockstar jeans may work for older customers, younger generations are more interested in the trendier, wide-legged pants mentioned earlier.

When asked about Old Navy’s recent collections, a young editor at Pop Sugar wrote in September of this year:

“I’m not quite ready to jump back into a pair of jeans, so I decided to opt for these Old Navy Extra High-Waist Wide-Leg Pants. Not only are they comfortable, but they’re also so versatile.”

If Old Navy had been provided data on this trend earlier, there would have been no missed collections to speak of. For designers, merchandisers, and buyers, trend forecasting really is a game changer.

Better collections, greener vision: A more sustainable Old Navy

However, qualitative and quantitative data are equally important when it comes to fashion, especially considering that millennials and Gen Zers are more eco-conscious than their predecessors, and tend to view purchasing decisions as a reflection of their values. Sustainability is a salient value for younger consumers who are increasingly leaning towards green, transparent brands. Many major retailers have caught on already: H&M’s Conscious Collection is just one example that has drawn significant positive attention from younger audiences. But for Old Navy, the retailer is largely considered as a fast fashion brand, an image which has the potential to damage sell-through and desire.

Fortunately, this is another area in which trend forecasting can be of use, notably in terms of inventory planning. If design and merchandising teams know precisely what to produce, and in what quantities, there is much less risk of accumulating excess inventory. A surplus of clearance inventory is a major problem for big retailers who produce large quantities as a rule, and often, this inventory is never purchased or is thrown out. Collections created with the assistance of trend forecasting can directly increase store visits and sales while reducing potential environmental harm by producing accurate quantities to precisely meet consumer demand.